Sustainability Linked Bonds Pricing

A Sustainability-Linked Bond (SLB) is a bond whose financial characteristics are tied (“linked”) to specific Sustainability Performance Targets (SPT). If a target is missed, the yield on the bond increases. In other words, issuers will be held to their promises, and if they fail to deliver there will be a financial penalty. This penalty generally takes the form of a step-up coupon.

SLBs are quickly developing in the corporate space. The market is expected to grow steadily in 2021 with total issuance ranging between 100 and 150 billion $.

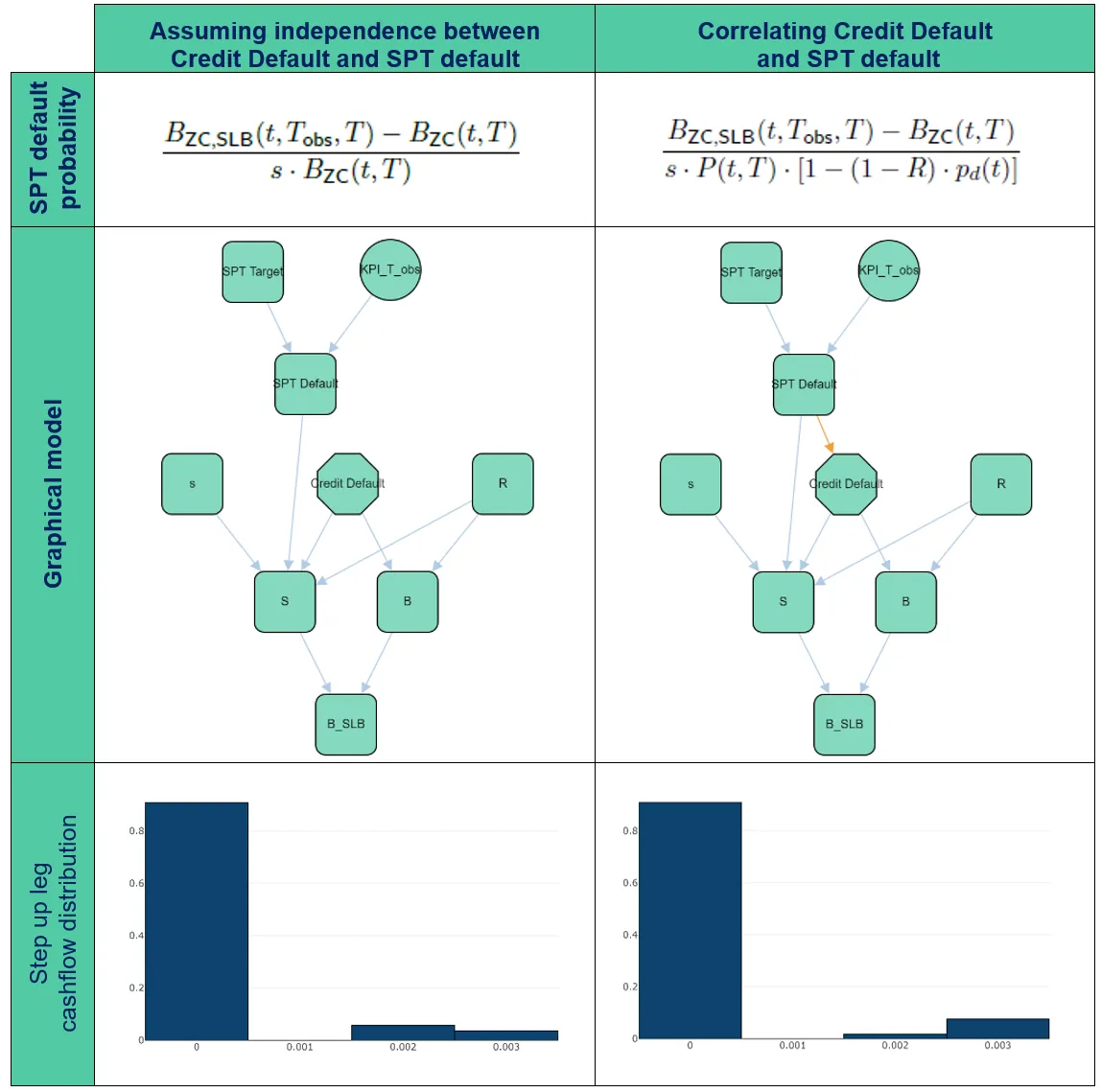

Compared to classic bonds, pricing SLBs involves a new risk component, that of SPT default. The latter is to be modelled on top of the issuer’s credit default risk. Probabilistic graphical models provide a simple yet powerful means to model jointly credit and SPT default for SLBs pricing and risk modelling and in particular the validation of SPT default probability estimator.

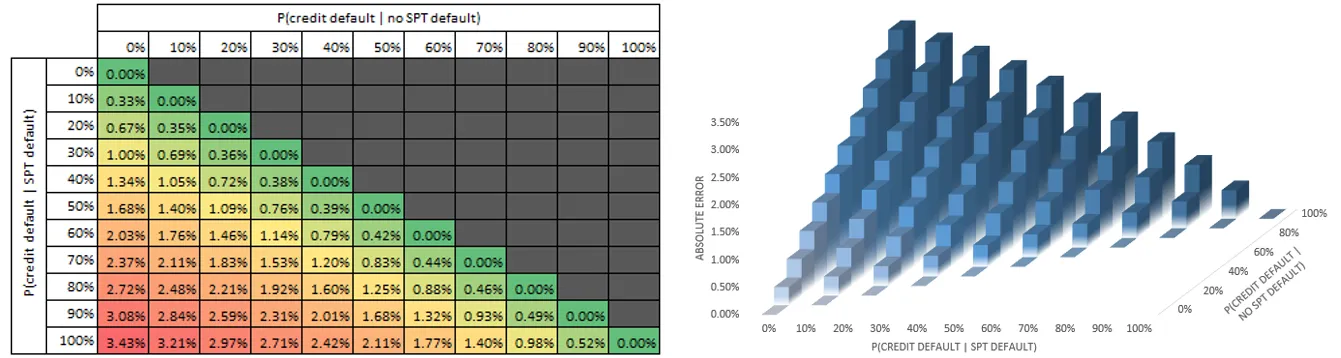

The above results are obtained in the case of a hypothetical SLB with SPT default probability of 9%. The diagonal corresponds to cases where SPT and credit events are independent for which we recover accurately the 9% SPT default probability. The worst case corresponds to the fully correlated case (bottom left of the table) where the absolute error reaches 3.42%.

This result is powerful as it shows limited accuracy loss when assuming SPT and credit independence, under which the SPT default probability can be derived from observable market data.